How to Invest in Bitcoin

If you are interested in learning about investing in Bitcoin, read the detailed step-by-step guide below. We will talk about how to choose a reliable broker for BTC trading, the possible risks and the most profitable strategies.

Choosing a broker to invest in Bitcoin is just one of the challenges. It is also extremely important to study the question of how to invest in Bitcoin, taking into account all possible risks – and the risks are high, because, like all other cryptocurrencies, Bitcoin is very volatile, i.e. its course is constantly changing to a very large extent. So, in order to properly invest in Bitcoin, be sure to read the information we provide below.

What is Bitcoin?

Almost everyone knows about the growth in the BTC value, but few know what Bitcoin is. Let's start with the fact that Bitcoin is a digital currency, i.e. it does not have a physical form, it is stored in the so-called blockchain, a public ledger located in the online space. Thanks to the blockchain, Bitcoin cannot be controlled or wholly owned by an individual.

This technology is in no way connected with any state or central bank – full decentralization is ensured (the absence of a single controlling body).

Bitcoin was created as a technology to replace the current monetary system (conventional currencies like the dollar, euro, etc.). Bitcoin can be sent and received to electronic wallets without intermediaries. Wallets can be websites, mobile and computer applications and programs, as well as individual devices (hardware wallets).

Operations in Bitcoins are always anonymous and are completed in just 10 minutes, while regardless of the amount of the transaction, the commission is usually no more than a dollar. Finally, the Bitcoin network is extremely secure, which also adds to its popularity.

Unlike fiat currencies, the release of which is not limited and is determined by the economic needs of the state, the maximum emission of Bitcoin and the increase in the complexity of mining are written in the code. In Bitcoin, value is based on a deflationary model. The decentralized software provides for the generation of only 21 million coins, which users extract using mining – computing operations. If in 2009 Bitcoin mining cost almost nothing and was available from any home computer, now its price is due not only to a limited release, but also to the difficulty of obtaining new coins.

Benefits of Investing in the Leading Cryptocurrency

- Many people cannot decide whether it is worth investing in Bitcoins, because digital currencies have not yet fully entered the legal field of most states. According to many experts, investments in Bitcoin can be assessed as risky, but highly profitable. The features of the coin include the following:

- The absence of a single emission center, non-attachment to a specific financial organization that exercises control over the currency. Commissions are taken only by exchangers and wallets.

- Anonymity. When creating a cryptocurrency wallet, the user does not indicate his personal data, and when transferring funds from one wallet to another, third parties in the blockchain will only be able to see encrypted wallet addresses.

- Irreversibility of transactions. If the money has left the account, it is impossible to return it even if the transfer was erroneous.

The issue of the coin is limited to 21 million units, most of which have already been mined. This means that the value of the crypt will only increase in the future.

How to Invest Bitcoins?

Investing in Bitcoin means buying a cryptocurrency at a certain value with the aim of selling it later for a higher price. There are a number of ways to invest in Bitcoins. Experts note two main strategies for how to make money on Bitcoin. They are generally similar to working with traditional money. The choice of the right one depends on the investor's ability to "freeze" a certain amount of funds for a long time or the willingness to engage in trading on a regular basis.

There are general rules that apply to all of these options: it is better to choose projects that bring profit in the invested currency; do not convert funds too often, as this leads to the loss of part of the money in the form of a commission.

Investment Funds or Exchanges

This is an opportunity to place Bitcoins at interest, it is similar to a standard bank deposit. The founders of the fund place funds in various Internet projects, buy promising assets or play on the stock exchange and pay a part of the profit to investors (for example, on the MyDailyCoin resource, about 3% of the deposit amount daily).

At the same time, the choice of a fund should be treated very responsibly, since a large part of them are fraudulent schemes. It is advisable to keep track of specialized forums in order to know exactly the funds that pay interest and avoid being scammed. If the site offers to invest money and promises huge interest, then you should be wary.

The main problem of investment funds is the lack of guarantees for a stable profit. Even if its organizers are honest people, they can also make a mistake in assessing the profitability of the undertaking financed by them and incur losses. The same applies to stock trading.Therefore, the best advice may not be to invest large amounts in one project, but to diversify risks and invest Bitcoins in several promising areas at once.

Mining Digital Currency

Here, rather, it is about receiving them, while expenses are more often carried out in dollars or rubles. Since Bitcoins, like other digital coins, are codes, they are mined through complex calculations on specialized equipment. There are several options for mining cryptocurrency.

Classic mining involves the purchase of powerful equipment and independent calculation of blocks using special mining programs. Since Bitcoin mining has become very complicated recently, even powerful home farms from several modern video cards do not guarantee success. It is necessary to purchase special expensive ASIC devices, which in the end may not pay off.

Mining in a pool. Pool is a community of miners who work on computing blocks as a single system. The power of their computer technology is combined with special programs, which significantly increases productivity and the chances of receiving a reward for computing a block. The reward is divided among all participants depending on their contribution. This method makes it possible to receive a relatively stable income, although it is unlikely that it will be possible to get rich on this.

Cloud mining. In this case, customers are offered to rent computing power, they do not need to build their own farm and pay electricity bills. The user enters into a contract with a firm to rent a certain amount of M/Hs for a specific period. Data centers, consisting of many ASIC devices, are located in different countries. Earned crypto coins become the property of the tenant. When choosing a pool, you should pay attention to several conditions. These are the power of the required equipment (the higher the better), the way the reward is distributed among the miners, the amount of the commission and the possibility of withdrawing funds (support for various payment systems). The most popular services are NanoPool, CoinMine, Suprnova, MinerGate, NiceHash. Among cloud resources, Cointellect, HashFlare, BitMiner, GenesisMining, EOBot, GigaHash, BitClub NetWork are in the lead.

Often, for the convenience of users, a mining pool, a service for renting or leasing capacities, and a cryptocurrency exchange are hosted on the same resource. Such options enable the client not to spend money on withdrawing crypto from the mining site and entering it on the exchange, but to carry out these operations within one resource.

ICO

There is also another option where to invest in Bitcoin. We are talking about blockchain projects that are put up for ICO. Simply put, the company offers the community a promising product that needs money to refine and implement. Potential investors study the offer and buy tokens specially issued for the initiative, which can later be traded on a crypto exchange. The more money raised, the more promising the project and the more expensive its tokens are valued. ICO is a rather risky Bitcoin investment.

The most successful ICOs (EOS, Bancor, Tezos) have raised hundreds of millions of dollars in weeks or even days. However, you need to be very careful here, because often an ICO turns out to be a scam (deception), and its organizers disappear with the money of investors.For this reason, Google recently announced that it will not place advertisements for cryptocurrencies and ICO projects, rejects such advertising and Yandex.

As you can see, there are enough ways to attach your savings to digital cash. Only the owner of the money can decide whether to invest in Bitcoin, after weighing all the pros and cons. You can invest in BTC either on your own or with the help of professionals from the Bitcoin Storm.

Bitcoin Investment Strategies

Let's talk now about how to invest in Bitcoin using the most profitable strategies. In any case, regardless of the asset, you always need to understand when to make a deal and when to close it in order to get the maximum profit.

Cost Averaging

This strategy is used in all financial markets. Its essence is to invest in an asset little by little, but constantly, in the end without overpaying for it.

Let's say you can invest $20 a week in the near future; by doing this, you level the volatility, since the asset purchase rate will be either higher or lower, and you will eventually reach the average value.

Example:

first week: deposit $100 at a cost of 50,000 BTC;

second week: deposit $100 at a cost of 35,000 BTC;

third week: deposit $100 at a cost of 40,000 BTC;

Week 4: Deposit $100 at 55,000 BTC.

As a result, it turns out that the average cost that you have achieved in a month (4 weeks) is $45,000.

Diversification

Diversification refers to the distribution of risk across different assets or markets.

In the case of Bitcoin, it also means investing in other cryptocurrencies. In theory, such a strategy should reduce risk, since when trading several assets, it is lower than when you invest everything in just one. However, the problem is that all available cryptocurrencies need to be stored in the wallet, and this can confuse you a lot, since some wallets only support certain currencies, and therefore you will have to open several at once.

Buying at the lows

Just a day before this article was written, the price of bitcoin fell by 10%. Whether this is a short-term fall or the beginning of a long-term trend remains to be seen. However, those who are confident in the long-term prospects of Bitcoin may well apply the strategy of buying at local or large-scale lows. This strategy works not only for Bitcoin, but for any asset.

The method of applying this strategy depends on the goals and style of the investor himself.

Some even buy Bitcoin almost every day, as soon as its value falls by 5%, i.e. as if at a discount. In fact, this is the same average cost strategy (if the investment amount is always the same).

How Much Can or Should You Invest in Bitcoin?

At the time of this writing, the cost of Bitcoin was over $20,000, which begs the question: how much does it cost to invest in Bitcoin and who can afford it?

We will immediately stipulate that it is not necessary to buy a whole Bitcoin; Bitcoins, like conventional currencies, are divided into smaller components. For Bitcoin, this is satoshi, which is equal to 0.00000001 (one hundred millionth) of Bitcoin.

On some brokerage platforms, you can invest in Bitcoin in very small amounts, from $25, so you don’t need a huge amount of capital. Of course, no one will forbid you to invest tens of thousands of dollars, but you need to do this wisely and be aware of all the possible risks.

Possible Risks

When deciding whether to invest in Bitcoin, each user must be fully aware of all the dangers that await him when investing in cryptocurrency. There are both risks inherent in any money in the financial markets, as well as specific features of the turnover of Bitcoins and altcoins. The main risks include the following factors.

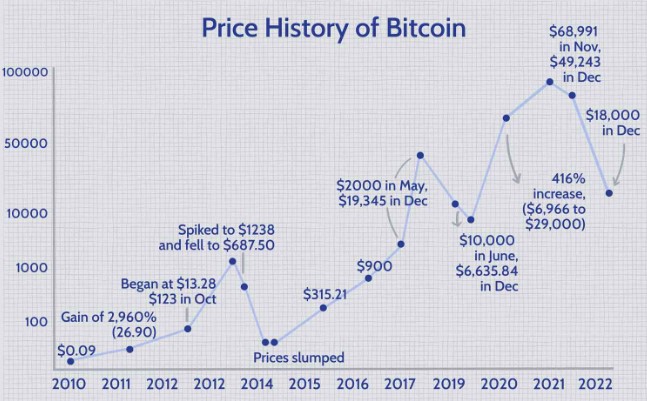

- Volatility: Bitcoin’s huge rise can turn into an equally strong fall at any time, so there is no guarantee that after a spectacular rise from the $5,000 low, it will not collapse again. Suffice it to recall 2017 here. At the beginning of that year, bitcoin was worth about $1,000.By the end of 2017, it had already reached a maximum of 20,000, i.e. increased by 1900%. However, then an unsuccessful streak began, and a year later the cost of bitcoin fell to $3,000. Thus, those who bought Bitcoin at the peak in 2017 lost 85%! In order to reach the already set maximum, the cryptocurrency took another couple of years: in 2020 it again began to cost $ 20,000.

- Hacking and fraud: scams and hacks present additional risks for those who want to invest in bitcoin. Hackers have already targeted Bitcoin exchanges more than once or twice, as a result of which client money has disappeared. The amounts of lost funds sometimes amounted to tens of millions of dollars, while there was no way to return them, because we are talking about virtual currency. But that's not all: due to the anonymity of the blockchain, bitcoin has also become a favorite tool for scammers. Here we can note fraudulent attacks on operating systems, substitution of SIM-cards and "good old" financial pyramids.

- Lack of control by central banks. Supporters of digital currencies position this moment as unambiguously positive, since there is no dependence on the state. At the same time, no one will give you a guarantee of payment of what you earn in case of fraud or hacker attacks.

- The uncertainty of the legal status in most countries of the world makes Bitcoin investments a risky venture. While the government, together with the Central Bank, is developing a bill to regulate cryptocurrencies, news regularly appears in the media that crypto transactions can be declared illegal or taxed. On the other hand, there is an opinion that the cue ball will soon be recognized as an official means of payment.This situation brings some nervousness and makes you wonder whether it is worth it to engage in crypto-investment and whether it is profitable to get involved in such an unpredictable market.

- Lack of acceptance. Despite the fact that the number of companies accepting Bitcoin as payment is gradually increasing, the coin has not yet passed into a mass means of payment. To make investments in Bitcoin less risky, the crypt needs to have a strong link to the real market, otherwise it will be just numbers on the display.

Is Bitcoin a Good Investment?

Now is the time to talk about whether it makes sense to invest in Bitcoin.

There has never been an asset in the market (even among the most volatile ones) that has grown so fast. However, initially, when Bitcoin first appeared (in 2009), it had practically no value. Even a few years after its inception, Bitcoin was hardly worth a single cent! And yet, in February 2021, it hit an incredible figure: $57,000. In general, if 10 years ago you bought at least a few dozen Bitcoins, now you would already be a millionaire.

It’s easy to talk about it now, when everything has already happened, but then few people even knew about Bitcoin.However, even now Bitcoin could still be bought relatively cheaply (relative to the current value, of course): for $5,000.

It is generally impossible to imagine what figure Bitcoin can reach in the future, but some analysts are still trying to do this by comparing cryptocurrency with gold. Indeed, Bitcoin and gold have many similarities: both assets are a store of value, they are exhaustible, divisible, and so on. On this basis, it is concluded that the value of Bitcoin should reach the moment when its capitalization can exceed the capitalization of gold.

However, there are those who are ready to go even further in their thinking, saying that Bitcoin will replace the dollar as the world's reserve currency. And if suddenly this turns out to be true, then there will simply be no upper limit on the value of the cryptocurrency.

Perhaps one of the main signs that Bitcoin is there for a long time is its support from the world's leading companies.

First of all, of course, we are talking about Tesla, a car manufacturer that is valued at more than $680 billion. Elon Musk's company recently announced that it has invested $1.5 billion of its foreign exchange reserves in Bitcoin.

Next, there is PayPal, an electronic payment provider that has recently started working with cryptocurrencies.

These are just a few examples when the largest companies are somehow ready to work with bitcoin. Everything looks so that investments in this cryptocurrency bring exceptional success.

Questions & Answers

Is it worth investing in Bitcoin?

When investing in Bitcoin, both the potential rewards and risks are much higher than when trading traditional market assets like stocks, so you need to be prepared for a sharp turn of events that can happen at any moment.

Maybe it's too late to invest in Bitcoin?

Enthusiasts will tell you no. Of course, you have already missed the most impressive phase of growth (since 2009), but this does not mean that there will be no more growth.

Is it safe to invest in Bitcoin?

It ultimately depends on how you choose to invest in bitcoin. For example, if you use an unregulated offshore cryptocurrency exchange, then you put your funds at risk.

What is the minimum amount that can be invested in Bitcoin?

The minimum amount depends on the chosen broker or exchange.

Are there derivative contracts for Bitcoin?

Yes. In some countries (for example, in the UK), CFDs and other derivative contracts for bitcoin are prohibited, but in many others they are allowed.

Can you buy Bitcoin with PayPal?

Of course you can. Some brokers allow you to buy bitcoins with Paypal. You will still benefit from the investment with no commission and the minimum bet is still $25.

Conclusion

On the one hand, Bitcoin has a huge capitalization. It is still not large in the global economy, but it is already twice the cost of all other crypto coins issued. Theoretically, this could mean that investing in Bitcoin before the emission is fully generated can pay off many times over, since stopping mining will make the cost of one coin higher than ever.

On the other hand, we are already seeing systematic restrictions or a ban on the circulation of cryptocurrencies in various states. On the one hand, this also increases the cost of Bitcoin, but on the other hand, if most of the civilized world comes to criminal prosecution for transactions with virtual currency and refuses to exchange for fiat money, Bitcoin will go entirely to the black market and its solvency in the "white" segment will be reduced to zero.

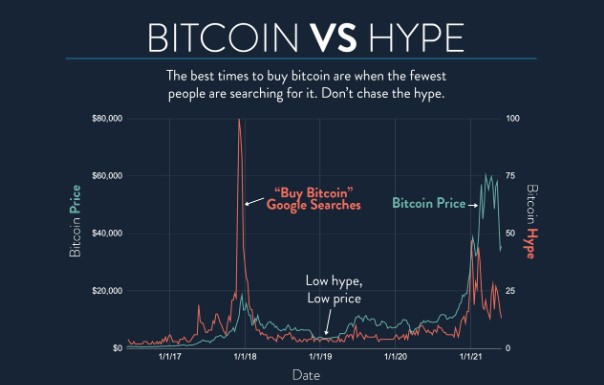

Analyzing the latest global trends, we can say that both one and the other option can be equally likely.Today, given the huge cost of BTC and the risks associated with the future fate of the cryptocurrency, investing in it can be considered risky. Potential buyers of Bitcoin can only be recommended to “keep abreast” and regularly be interested in new bills and events in the world of crypto assets. It is also recommended to monitor the social networks of open Bitcoin holders, as their statements can lead to both a sharp increase and a collapse in prices for cryptocoins.