In 2022, Russia was the leader in the ranking of gas exporters with an export volume of 241.3 billion m3. The United States was in second place with 179.3 billion cubic meters of exported gas, and Qatar closed the top three with 127.9 billion cubic meters of exported gas.

In the near future, the situation promises to change dramatically – the military aggression of the Russian Federation against Ukraine, which began on February 24, 2022, turns Russia into a pariah country: politically, culturally and economically.

Civilized countries are taking all possible steps to completely abandon the export of goods from the aggressor state. In 2022, more than 10,000 sanctions were imposed against Russia, more than against any other country in history. Gas remained a serious "extra nutrition" for the Russian economy, and European states were forced to sponsor the Russian Federation, buying natural gas in the same volumes.

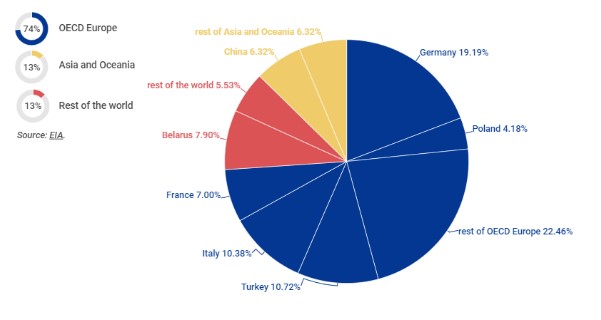

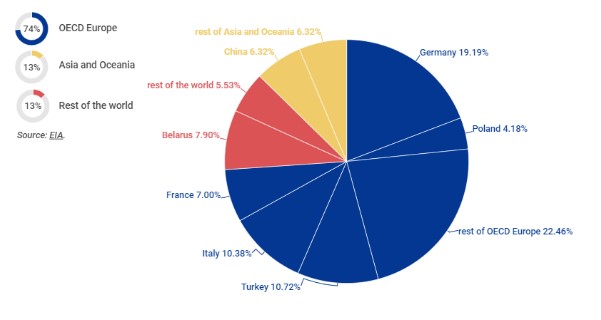

The Baltic Pipe gas pipeline project promises to end the era of Russian gas power – the pipe connects Scandinavia with central Europe, allowing the Russian Federation to be replaced by Norway as a gas exporter. Meanwhile, the aggressor country exports 63.21% of the total volume of gas to the EU countries, so the loss of this direction will entail a serious redistribution of the world market.

The Baltic Pipe is not only the gas independence of Europe from Russia, but also a unique opportunity to invest right now in a promising direction, the capacity of which promises to grow exponentially. Did you think that investors in the gas sector are oligarchs, millionaires or sheikhs? The Baltic Pipe is an example of the fact that everyone can "bite off" their "piece of the pie" in this market, but it's better to hurry – the pipe is not rubber, there will not be enough for everyone.

Baltic Pipe – project description

The idea of the gas pipeline was developed back in 2001 – the creation of the Baltic Pipe was initially developed by Polish and Danish state-owned companies, but then the project was suspended due to economic inexpediency. They returned to it in 2007, and two years later the Baltic Pipe gas pipeline appeared in the European Commission's application for grants. But the project was again frozen for various reasons.

Once again, they returned to it in 2021, but now they have taken the initiative seriously – on April 30, 2021, the start of construction of the gas pipeline was announced in an official statement by Polish President Andrzej Duda. The following year, construction was completed and the gas pipeline was put into operation, allowing natural gas to be supplied from Norway to Poland and other countries.

The total length of the gas pipeline was 900 kilometers, and the annual volume of exported gas reached 10 billion cubic meters, and they plan to develop the ecosystem further in order to fully provide Europe with natural gas.

Project Prospects

To date, the total volume of gas exported from Norway to European countries via the Baltic Pipe gas pipeline is limited to 10 billion cubic meters, but the development of the ecosystem will allow increasing these volumes. But even with such capacities, natural gas is enough to cover the needs of at least the whole of Poland.

Norway is in fourth place in the ranking of gas exporting countries. The country exports 113.1 billion cubic meters of natural gas annually, with Norway having huge potential to increase its export volumes.

The Polish side claims that in 2023 the gas pipeline will be used at 100% of its capacity, contrary to claims that Baltic Pipe will be idle for nothing. Poland is already in the final stages of negotiations with top Norwegian oil and gas companies, as a result of which it is planned to sign strategically important gas supply contracts.

In addition, Baltic Pipe promises to be the beginning of Europe's gas independence, as Norway is ready to implement a number of projects in the gas sector, which will increase natural gas exports by 7% annually. According to experts, by 2030 Norway will be able to fully meet the needs of the European Union in natural gas.

The Situation in the Gas Market

In 2022, the global gas market was estimated at $300.4 trillion, and by 2032, experts predict this figure will grow to $424 trillion. For comparison, the US GDP in 2021 amounted to $23 trillion – the volume of the gas market is already estimated at 15 US GDP. The gas industry remains one of the most profitable, with natural gas prices breaking record after record.

In August 2022, the price of an ounce of natural gas hit an all-time high of $9.33. The upcoming redistribution of the market promises to be a new catalyst for rising prices, so investments in the gas industry look promising and reliable, especially against the backdrop of economic instability.

Gas Pipeline Owners

The Baltic Pipe gas pipeline is equally owned by Gaz-System and Energinet.

Gaz-System is a subsidiary of the Polish state company PGNiG. Gaz-System is responsible for gas transportation through all gas pipelines in Poland (with the exception of the Yamal-Europe gas pipeline).

Energinet is a Danish company responsible for the transportation and distribution of natural gas and electricity in the country. The main task is to develop the Danish energy infrastructure and provide equal access to it for every inhabitant of the country.

How Much Can You Earn?

The official website of the project says that the annual income from a minimum deposit of 250 euros is more than 118,000 euros. The profitability of the gas pipeline for a private investor is 47,200%. These are cosmic numbers, but an investor does not have to wait a whole year to get his profit. You can leave the project at any stage.

The site describes several examples of successful investments. Accountant Kasper Wrona earned 17,523 euros in two months, while driver Wojciech Jankowski earned 3,290 euros in just a week.

The earlier you buy project shares, the faster your capital will increase. If you wish, you can request a withdrawal of funds at any time, and they will be credited to your card within 24 hours with a zero commission.

Can You Trust the Project?

The traditional question of every investor: “Can I trust this project? What if he turns out to be a scam?” A similar question arises in relation to investments in Baltic Pipe.

You can give hundreds of arguments in favor of investment, but I will just give a few eloquent facts.The construction of the gas pipeline is estimated at $1.7 billion. Poland's PGNiG has spent another $615 million to buy the Norwegian offshore natural gas field Duva. From January 1, 2023, agreements with Norwegian companies for the supply of gas through the Baltic Pipe gas pipeline came into force, and not only the Polish government, but the entire European Union is interested in the success of this project, since gas exports from Norway will help to significantly reduce dependence on Russia.

This project is becoming one of the highest priorities in the EU as a whole, and in Poland in particular, so Baltic Pipe can turn into a Klondike of the 21st century for investors.

Legislative Regulation Features

The project is managed by Polish and Danish state-owned companies, so Baltic Pipe operates in accordance with all EU legislation.

The investor is offered to invest in the shares of the project and become a participant in the stock market. You can invest in shares in any country, it is not prohibited by laws. The main thing is to pay income tax in accordance with local regulations.

Gas

Gas

Oil

Oil

Natural Gas

Natural Gas