Buybacks How It Works: Reaping the Benefits of Nornickel Buybacks: What You Need to Know

What is a Buyback?

A buyback is a process in which a company purchases its own shares from shareholders. The company repurchases these shares from the open market or from existing shareholders, depending on the company’s preference. This practice is seen as a way to increase the value of the company’s stock and provide a return to shareholders. By buying back its own shares, the company reduces the number of shares outstanding, which can drive up the price of the remaining shares.

Buybacks are not new and have been used by companies for decades. In the past, companies have used buybacks to reward shareholders, as they can be seen as a sign of confidence in the company. In recent years, however, buybacks have become increasingly popular, as companies seek to use them as a way to return profits to shareholders and increase value. Nornickel is no exception and has used buybacks to increase shareholder value. The company has long been a leader in this area, as it has a history of buybacks stretching back to 1995.

Nornickel’s Buyback History

Nornickel has a long history of buybacks. The company first implemented a buyback program in 1995, and since then it has regularly repurchased its own shares. The company’s most recent buyback program was announced in 2018 and was worth a total of $5.5 billion. This was one of the largest buyback programs ever implemented by an individual company.

The company has also used buybacks to reward shareholders. In 2019, the company announced a special dividend of $100 million, which was paid out to shareholders who held the stock on the payment date. This was seen as a sign of the company’s commitment to rewarding its shareholders.

What are the Benefits of Nornickel’s

Investing in Nornickel, one of the world’s largest mining and metallurgical companies, can be a lucrative enterprise. With its share price consistently on the rise, and its strategy of buybacks that increase dividends for shareholders, the potential for greater returns is clear. But what exactly are these buybacks and how can you benefit from them? Understanding Nornickel’s buyback policy is essential for investors looking to reap the rewards of investing in the company. In this article, we’ll explore what buybacks are, how Nornickel’s buyback policy works, and how you can use it to your advantage.

Nornickel’s buyback policy has several benefits for shareholders. First, it provides shareholders with a return on their investment. By repurchasing its own shares, the company is essentially returning profits to shareholders. This can result in an increase in the share price, which can lead to higher dividends and increased shareholder value.

Second, buybacks can be seen as a sign of confidence in the company’s future. By buying back its own shares, the company is indicating that it believes its stock is undervalued and that it expects future growth. This can be a strong signal to investors that now is the time to invest in the company. Finally, buybacks can also help to reduce volatility. By reducing the number of shares on the market, buybacks can reduce the likelihood of large swings in share prices. This can give investors more confidence in their long-term investments.

How to Invest in Norilsk Nickel

If you’re interested in investing in Nornickel, the first step is to open a brokerage account. You can do this through a broker or online. Once you’ve opened an account, you can buy Nornickel shares through the stock exchange. You can also buy options contracts, which are a type of derivative that gives you the right to buy or sell a certain number of shares at a specific price.

Once you’ve bought your shares, you can track their performance through a variety of online tools. You can also use these tools to keep track of Nornickel’s buyback policy, as the company regularly announces buyback plans.

Strategies for Investing in Nornickel

When deciding how to invest in Nornickel, there are several strategies to consider. One strategy is to buy and hold. This involves buying a set number of shares and holding them for a longer period of time. This strategy works well for investors who are interested in long-term returns, as it allows them to benefit from the growth of the company’s share price over time.

Another strategy is to use buybacks to increase your returns. By buying and holding a set number of shares and taking advantage of buybacks when they are announced, you can increase your returns. This can be particularly useful for investors who are interested in short-term returns, as buybacks tend to increase the share price in the short term. Another strategy is to invest in options contracts. Options contracts give you the right to buy or sell a certain number of shares at a specific price. This can be a good strategy for investors who are looking to take advantage of short-term movements in the share price.

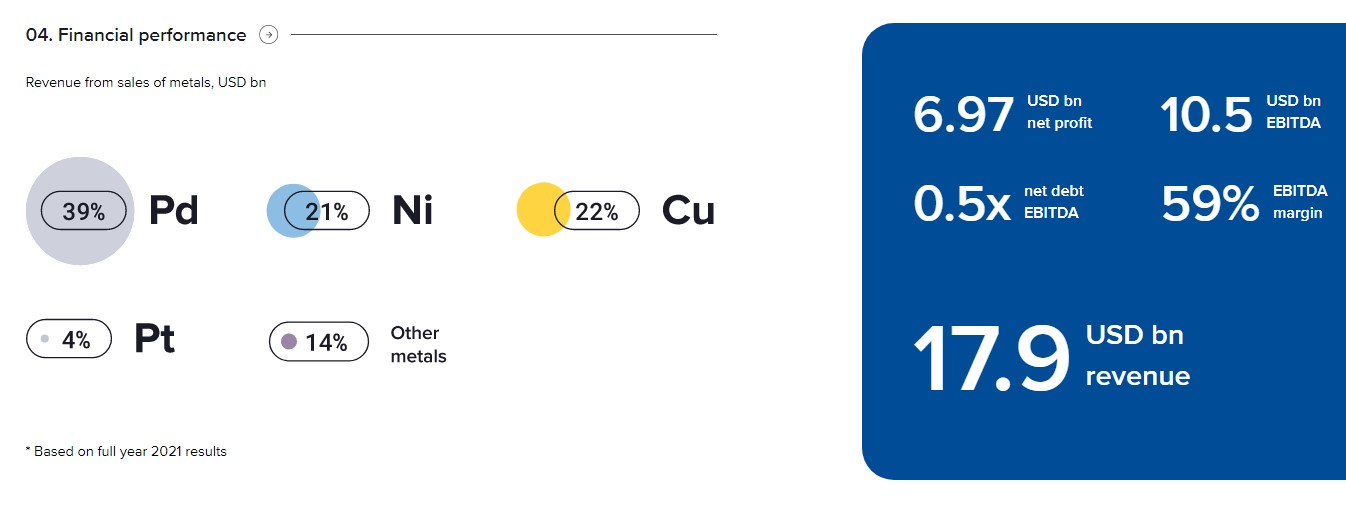

Nornickel’s Financial Performance

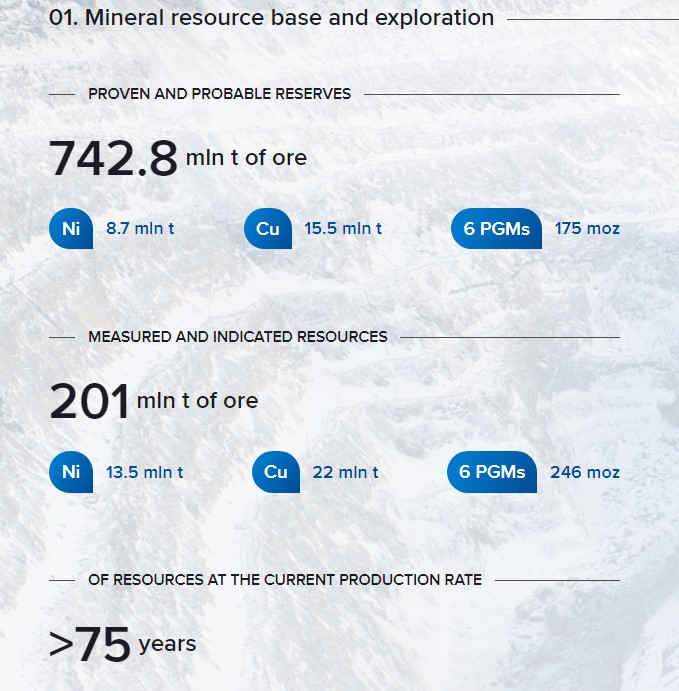

Nornickel’s financial performance has been strong in recent years. The company’s revenue has grown steadily, and its profits have also increased. This has been driven by strong demand for its products, such as palladium and nickel. The company’s share price has also benefited from this strong performance, as it has consistently been on the rise.

Nornickel’s performance has been further bolstered by its buyback policy. The company has been an active buyer of its own shares, and this has helped to increase the value of its stock.

Advantages of Investing in Nornickel

There are several advantages to investing in Nornickel. The company’s share price has consistently been on the rise, and its buyback policy has helped to increase the value of its stock. Additionally, the company’s strong financial performance and commitment to rewarding shareholders has made it an attractive investment for many investors.

Finally, Nornickel’s buyback policy has made it easier for investors to take advantage of short-term movements in the share price. By investing in options contracts, investors can benefit from the company’s buybacks without having to buy and hold a set number of shares.

Conclusion

Investing in Nornickel can be a lucrative enterprise. The company’s share price has consistently been on the rise, and its buyback policy has helped to increase the value of its stock. Additionally, the company’s strong financial performance and commitment to rewarding shareholders has made it an attractive investment for many investors.

By understanding Nornickel’s buyback policy, investors can use it to their advantage. By taking advantage of buybacks, investors can increase their returns and reduce volatility. Additionally, investing in options contracts can be a good strategy for investors who are looking to take advantage of short-term movements in the share price. Ultimately, understanding Nornickel’s buyback policy is essential for investors looking to reap the rewards of investing in the company. By taking advantage of buybacks and investing wisely, investors can increase their returns and invest with confidence.